Quantum Computing U.S. Market Update, H2/2024

The U.S. government has been slow to renew its major support for quantum computing (QC) but will get to it eventually. Publicly traded QC companies are disappointing except for IonQ. And AI rules the minds of venture capitalists as well as company CTOs.

Some of the key themes in the spring Market Update were the U.S. government’s support for quantum computing, the stock market performance of pure-play companies, VC funding for quantum and the effects of AI on the quantum market. We revisit and update these topics below.

U.S. government will support quantum computing

The need for the United States to continue investing in quantum technologies – and, pointedly, to stay ahead of China in quantum – is one of the areas that Republicans and Democrats agree on. While there are calls for the new Republican government to considerably reduce government spending in 2025, quantum is not an area that will see the first cost cutting.

The National Quantum Initiative (NQI) is a program for quantum tech research funding passed during Donald Trump’s previous presidency in 2018. Its funding appropriations expired in 2023. The NQI is very important for the U.S. quantum ecosystem, being the main source of funding outside of the Department of Defense. This obviously matters for researchers but also for companies and much of the money is used for competitive contracts. As an example, Rigetti’s CEO Kulkarni said during their Q3 earnings call that the NQI is "critical for our funding in 2025 and the next few years."

The National Quantum Initiative Reauthorization Act has not become law yet and most likely will have to be re-introduced by the newly elected House of Representatives next year. The current bill would fund quantum efforts by four major agencies to the tune of $1.8 billion during 2025-2029. About half of that would go to the Department of Energy (DOE), over $600 million to the National Science Foundation, and the rest to NIST and NASA. There is a related bill in the Senate, DOE Quantum Leadership Act of 2024, to amend the original NQI and raise the stakes by further increasing funding at the Department of Energy by more than $1 billion in 2025-2029.

For Finnish quantum computing companies existing and future R&D collaboration with the U.S. should remain relevant. In addition to gaining access to knowledge, it will also help with market understanding and in creation of networks for the future.

The stock market values IonQ

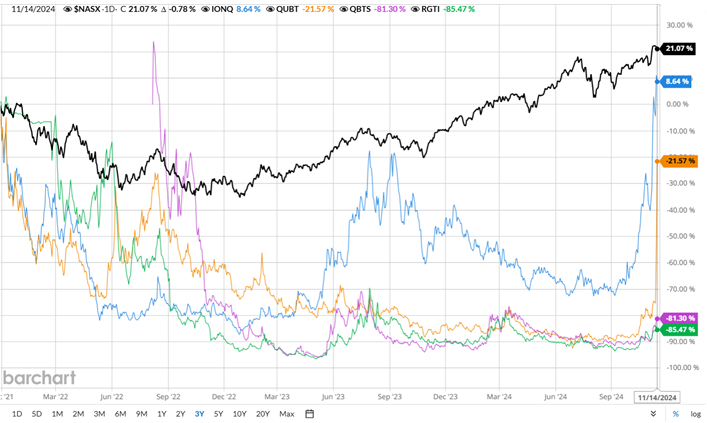

There are four companies publicly traded in the U.S. that we can look to for some information on how financial markets view quantum computing companies.

Legend:

NASX – Nasdaq Composite Index

IONQ – IonQ

RGTI – Rigetti Computing, Inc.

QBTS – D-Wave Quantum Systems Inc.

QUBT – Quantum Computing Inc.

The 3-year graph shows that one company, IonQ, is a star within this group. I’ll briefly go through the latest performance of three of these companies:

- IonQ is doubling revenues over last year and has a very strong financial position. They do not need new funding anytime soon, and just spent $22 million to buy the quantum networking company Qubitekk. The acquisition, which should close within six months, provides synergies to IonQ’s current computing technology, a nice patent portfolio, and potential access to new customers (telecommunications companies). Of special interest is that the split of revenues between hardware and services (including cloud access) has turned to HW being the larger component in 2024. In late September IonQ announced signing a multi-year, $54.5 million contract with the United States Air Force Research Lab, which is the largest known single contract this year.

- Rigetti’s revenues are flat from 2023. Notably, QCaaS revenues fell and hardware sales (mostly a 24-qubit system for the UK’s National Quantum Computing Centre) have poorer gross margins than the service business. Still, net losses are smaller than before as Rigetti is able to maintain the cost cutting they did last year. Their customer base remains highly concentrated, with the top four customers accounting for 72% of revenues and government contracts being more than 90% of revenues in the first three quarters of 2024.

- D-Wave has grown its revenues by 11% over last year and noted that QCaaS grew at a higher rate than this. This is an interesting comparison to Rigetti, which reported reduced QCaaS revenues. D-Wave was in violation of a covenant on one of their loans but received a waiver for it from the lender.

- We are not spending time on Quantum Computing Inc. because of its small size – total revenues for 2024 will be around $400 000.

A few other general observations from these companies:

- Shorting of QC stocks has become more common. Last spring only IonQ had a large amount of short-selling. Now others have gained short-sellers as well. IonQ has 21% of its shares daily float in short interest, Rigetti 17%. D-Wave 13%. A short interest of more than 10% of daily float is considered fairly high. Fewer than 50 stocks out of thousands currently traded on U.S. markets have a short interest of 30% or more.

- D-Wave is geographically diverse, with only 28% of revenues from the United States (and another 12% from Canada). Rigetti’s revenues are 67% from the U.S. despite public sales to the UK and Israel. IonQ does not separate revenues geographically or by customer type.

AI dominates funding of startup companies

It seems that venture capital in the U.S. will have a similar year in 2024 as in 2023 in terms of total deal value (perhaps around (around $175 billion) and deal count (around 15000 deals). These figures are similar to the numbers in 2020, before the over-heating and then inflation-induced cooldown in 2021 and 2022.

What these figures hide is the extreme interest in Artificial Intelligence, with funding chasing AI deals. Especially the value figure is inflated by extremely high valuations for specific AI companies.

The timing remains poor for raising funds for non-AI companies, but many U.S. startups are seeing the bottom of their cash coffers and must either raise funds or die. M&A activity remains very small as well.

Pushing AI-related aspects of quantum computing makes perfect sense in this environment. For example, D-Wave unveiled a new product development roadmap focused on addressing AI/ML workloads. But Zapata shows that AI is not always a savior, either. The re-branding of Zapata Computing was one of the topics in our March webinar as they were just about to go public via a Special Purpose Acquisition Company (SPAC).

Zapata AI ceased operations in early October 2024. The company is gone. Unfortunately, the process did not provide sufficient funds for the company – they netted a mere $4.5 million from the whole deal while incurring additional costs for professional services in the millions of dollars.

Interested in developing global growth business from quantum computing?